Simply put, this document establishes the terms of a sale. We even provide the means to monitor the status of your invoice so you’re never left out of the loop. With our innovative tools, you can create a template and send invoices to your clients through email, text message, or social media platforms. Looking for a shortcut for your business? You can use our online tools to create and send custom invoices in seconds.

#Proforma invoice meaning pro#

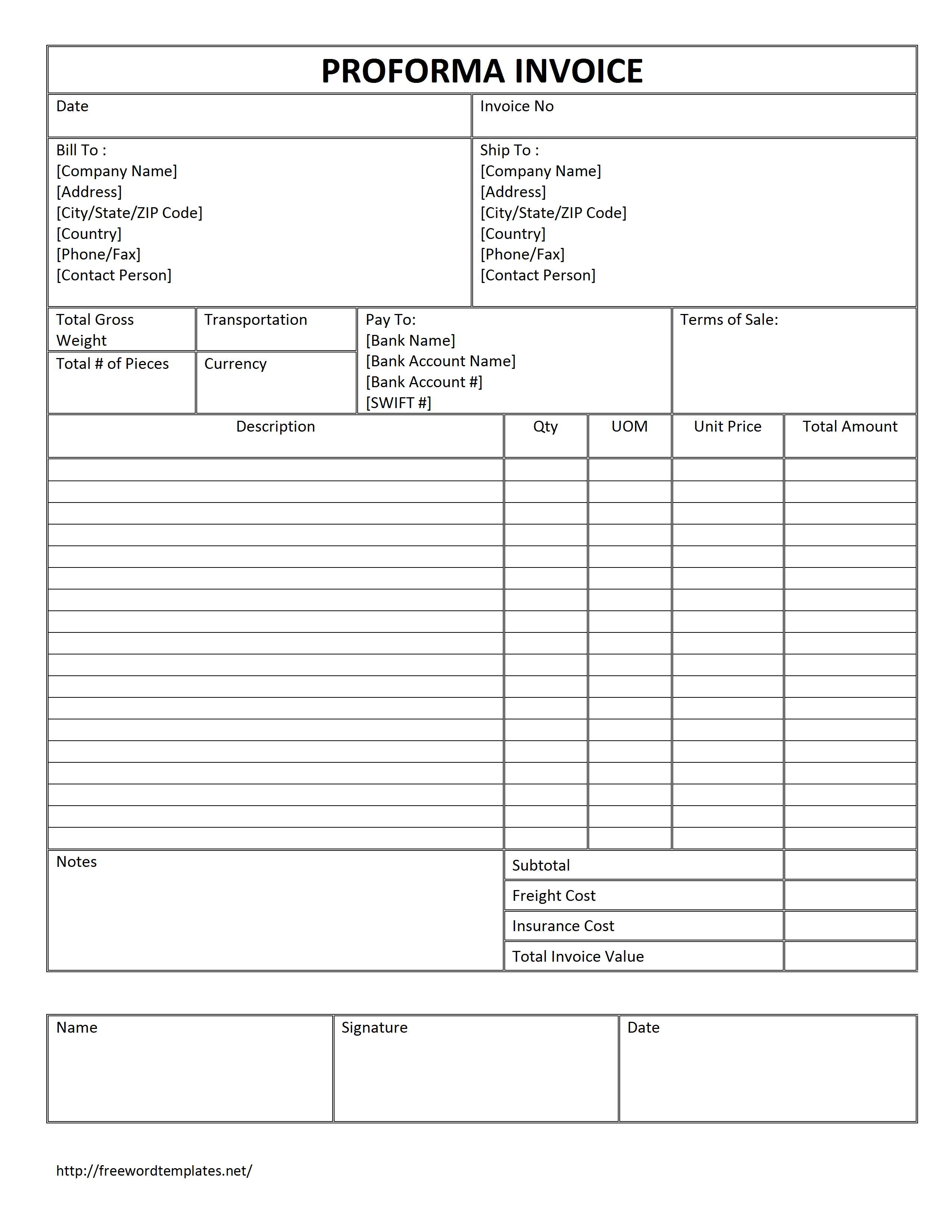

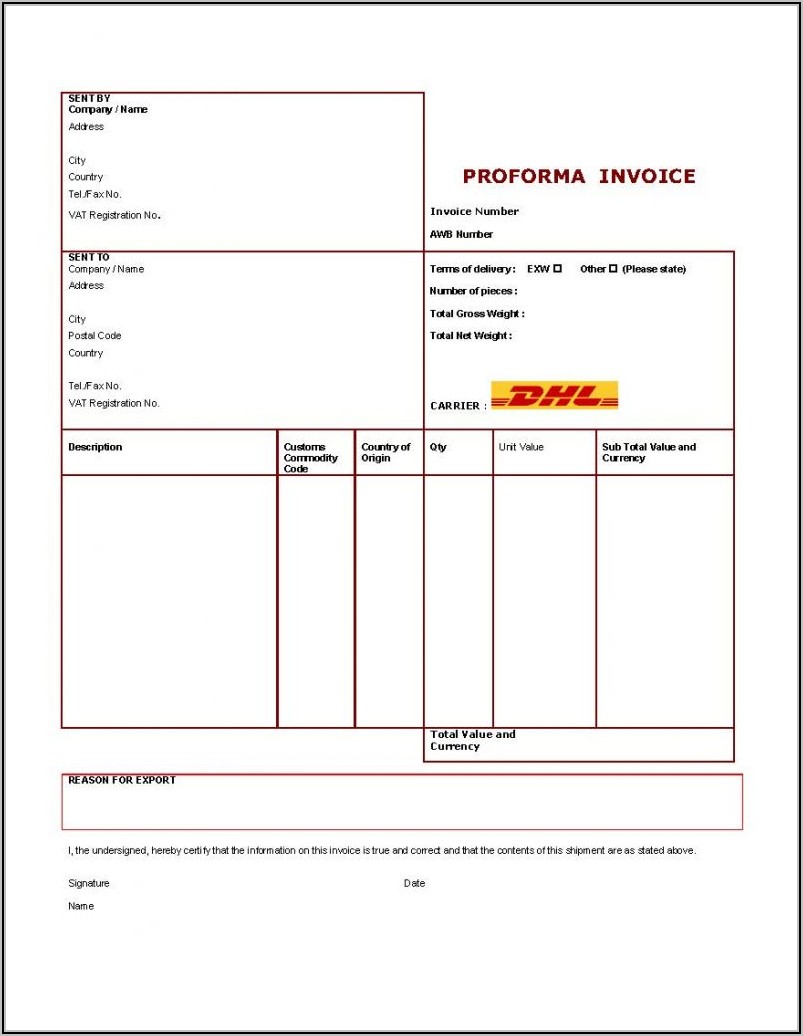

However, the pro forma protects the buyer from significant price jumps once the transaction is made final. In fact, the pro forma isn’t necessarily a guarantee of final costs, as prices may be subject to change. Since the pro forma is not a traditional invoice, it cannot be used for accounting purposes, nor is it a legally binding agreement. Therefore, a proforma might contain the following information: This form will list the goods and services involved in the transaction, as well as offering a price quotation that will ideally match the finalized invoice. In other words, a pro forma invoice functions as a good-faith estimate of the final costs of goods and services. From the Latin for “as a matter of form,” a pro forma invoice is intended to get all parties on the same page regarding the goods and services being rendered, as well as the price the buyer will be expected to pay. Instead, a pro forma invoice serves as a preliminary bill of sale.Ī pro forma invoice can be sent to a client before services are rendered or goods are delivered. Technically speaking, a pro forma invoice isn’t an invoice at all – at least not in the technical sense. In this article, we’ll take a deeper look at what proforma invoices include and how you can leverage them for your business. These documents reinforce your contract's terms of sale and can ensure mutual agreement between the buyer and the seller up to the time of delivery. Therefore, based on the Pro Forma invoice, the buyer may determine whether to buy the products or not.Looking to streamline the sales process of your business? Consider implementing pro forma invoices.

The main aim behind the drafting of a Pro Forma invoice is to provide the buyer, in advance, with an estimation of value, form of product and other payment terms.Besides this, the seller will supply the customs with a Pro Forma invoice to have the products issued at the port of entry.Furthermore, a Pro Forma invoice is used for shipments composed of products not intended for selling or buying, like presents, original product samples etc An importer often requires such an invoice to receive import permits, to create a letter of credit or to pay for funds.The supplier readies a Pro Forma invoice in response to such quote, giving expected cost and other details such as product description, sale terms etc A quotation accompanies a query like this. In the event of an export transaction, an enquiry is submitted by the prospective client sitting overseas. But, these invoices are used most commonly for transactions involving exports.A seller is thus expected to submit a Pro Forma invoice if the consumer demands such an invoice to learn the approximate price and the products to be delivered A Pro Forma invoice is usually given before the final transaction occurs.

0 kommentar(er)

0 kommentar(er)